DeHedge ICO aims to avoid fraud

About DeHedge

The DeHedge platform is a fundamentally new format with a developed infrastructure and a complex of powerful tools for the protection of crypto-investments.

The main task is to prepare a stable and convenient decentralized platform for hedging investors’ risks in crypto-currencies. The goal of the developers is to carefully consider the reliable protection of investments in the ICO and the security of crypto currency against the risk of fraud, failure of selected projects or serious fluctuations in rates.

The DeHedge platform prepares a fundamentally new, improved infrastructure for the reliable protection of crypto-investors. The main goal of the project is to create a stable decentralized platform for hedging the risks of crypto-investors. The project is designed to effectively protect investment in ICO and crypto currency in cases of fraud, exchange rate fluctuations or liquidation of projects.

Automatic payment of compensation

The work of the DeHedge platform is based on the use of the progressive technology of smart contracts Ethereum with the guarantee of automatic and full reimbursement in the event of a fall in the price of the hedged token. If desired, the investor himself can refuse to receive an automatic payment, independently deciding on a request for compensation.

Official pages of the project on the Internet :

Website: https://dehedge.com/en

Technical description: https://dehedge.com/documents/dehedge-whitepaper-ru.pdf

Coverage does not exceed reserves

Any transaction is reserved by a smart contract with the formation of security until the full recovery of losses incurred by the investor, according to the hedging option chosen by it. The investor gets convenient opportunities to accurately control the amount of reserved compensation through the block.

What gives DeHedge to investors — the progressive capabilities of the new platform :

– Protection of investors’ investments in ICO projects.

– Protection from excessive volatility of courses in the activity of crypto-currency traders.

– Preservation of profitability and attraction of investors for heads of investment funds.

– Attraction of investors in ICO-projects.

– Attracting additional investments for ICO sites.

– Protection against exchange rate fluctuations for buyers of mining farms.

How the DeHedge Platform Works — Effective Principles of Success

At the heart of the DeHedge platform, the progressive scoring model for accurate and objective evaluation of ICO projects is the author’s development based on the analysis of big data with the guarantee of investor protection in case of falling token rates or liquidation of the project.

How will the collected funds of ICO platform DeHedge :

80% of the funds under the project will be directed to the formation of a reserve fund.

12% of the funds received — for the development and development of the project, the content of a qualified team.

6% of funds — are directed to the tasks of marketing and general promotion of the platform.

2% of funds — for a complex of necessary accounting and legal services.

How will DeHedge platform tokens be distributed :

80% of tokens are allocated to the ICO.

15% of the tokens are provided to the project team.

2% are for the bounty program.

2% are allocated for advisers.

1% — for marketing tasks.

Forecast growth of the DHT token exchange rate:

The growth of the DeHedge tokens rate is affected by four indicators:

• Reduction in the number of free-token tokens;

• Increase in the hedge reserve;

• Increased demand for hedging;

• Increasing the product line by hedge

According to preliminary estimates by DeHedge, up to 15% of all tokens in free float will be simultaneously used in the hedging. At the same time, hedge market experts estimated that payments will be made through 25% of the hedging. Therefore, the number of tokens will be reduced by a quarter. DeHedge plans to increase the offer of hedging products for crypto-economics and crypto-investors.

"The development of the cryptographic money market depends on credibility."

Founder of DeHedge Mikhail Chernov, the founder of four IT companies. Chernov is also a trainer at the Sberbank project and Google Business Class, and graduated from the Moscow School of Management in Skolkovo.

Chernov argues that the development of the crypto money market depends on the safety of investments and the reliability of business projects, and on this issue does not allow the market to live a destiny similar to the DotCom crisis of the early 2000s

"We aim to reduce speculation."

Dmitry Ansimov, co-founder of the project, made his postdoctoral doctorate after graduating from Moscow School of Management Skolkovo.

Ansimov, former partner of Troika Dialog, claims the project aims to reduce speculation in the crypto money market. According to Ansimov, the crypto money market is still very new and needs to be regulated in the name of civilization and the necessary instruments to be added.

DeHedge Benefits

Overall, DeHedge aims to deliver benefits to ICO investors, cryptocurrency traders, institutional investors, and blockchain startups.

ICO investors are guaranteed the safety of their investments

Cryptocurrency traders can access protection against exchange rate volatility

Institutional investors can retain profitability and attract new investors by guaranteeing greater levels of protection than other funds

ICO projects can attract investors and protect against post-listing pump and dump schemes (investors will be more attracted to a project if it’s insured against a scheme like this)

ICO trading venues help to attract large investments in a project

Crypto exchanges insure transactions between clients

Crypto wallets can insure customer funds against hacks and protect their customers

Mining farm vendors can access protection against exchange rate volatility

As you can see, DeHedge aims to deliver major benefits to all members of the cryptocurrency community, from individual investors to the supply side. Companies can provide additional protection to their customers, while individual investors can purchase protection for themselves.

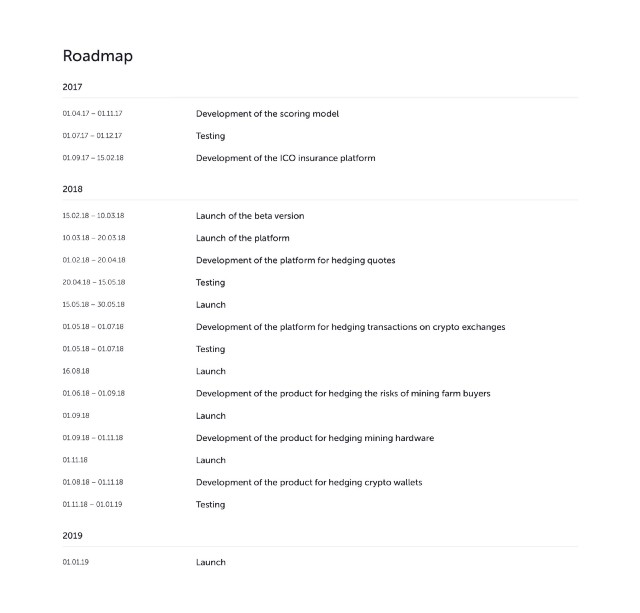

ROADMAP

The DeHedge Token Sale

Kết quả hình ảnh cho dehedge

DeHedge is issuing a total of 10,000,000,000 (10 billion) DHT tokens. 80% of the total supply will be sold during the pre-sale/crowdsale. 15% is going to the project team and co-founders, 2% is going to the bounty program, and 1% is going to marketing.

The ICO begins with a pre-sale from December 4 to December 17, 2017. DeHedge is seeking to raise $3 million during the pre-sale. Investors get a 25% bonus, with a base rate of 1 DHT = $0.0165 USD (or the equivalent in BTC / ETH.

The general ICO, meanwhile, is scheduled for March 2018, closer to the release of the beta. More information about the general ICO will be released in January 2018.

Who’s Behind DeHedge?

DeHedge is led by founder and CEO Mikhail Chernov. Other key members of the team include Bogdan Leonov (Co-Founder and CCO), and Dmitry Ansimov (Co-Founder and COO).

DeHedge Conclusion

DeHedge provides a unique level of protection to the crypto industry. You can purchase insurance packages through the platform to enjoy protection against price drops, exchange rate fluctuations, and unexpected events. DeHedge’s system is based on smart contracts that pay out automatically when certain conditions are met.

To learn more about DeHedge, visit online today at DeHedge.com. DeHedge will launch the beta version of its platform in February or March 2018, with the full platform launching by late March.

Website : https://dehedge.com

WhitePaper : https://dehedge.com/documents/dehedge-whitepaper-en.pdf

Twitter : https://twitter.com/De_Hedge

Facebook : https://www.facebook.com/dehedgeofficial/

Telegram : https://t.me/Dehedge

Bounty Thread : https://bitcointalk.org/index.php?topic=3008651.0

https://bitcointalk.org/index.php?action=profile;u=1344739

Комментарии

Отправить комментарий