L-pesa (PreICO) L-Pesa Microfinance

L-Pesa Microfinance is out to exploit the quickly developing requirement for money related administrations in the creating scene. L-Pesa's innovation stack is based over Amazon Web Services, a to a great degree adaptable on-request distributed computing stage which has been oris utilized by real brands, for example, Netflix, Airbnb, Pinterest, and Spotify. L-Pesa hosts incorporated various third get-together applications to perform assignments, for example, SMS informing, client check, and advertising. Assets exchanges are taken care of by means of reconciliations with versatile cash specialist organizations, for example, M-Pesa, Airtel Money, Tigo Pesa, and MTN. L-Pesa is a monetary administration that has helped a huge number of individuals everywhere throughout the world by giving microloans to help them kickstart or grow their organizations. The organization has been in presence for a long time with more than 150,000 enrolled clients. The advancement of things isn't yet adequate to all individuals around the globe, there are still a few nations that have monetary issues, particularly nations that are still in the creating time frame. Credit offices in some of these nations are likewise still hard to issue, some of these credit offices expect clients to have certain necessities.

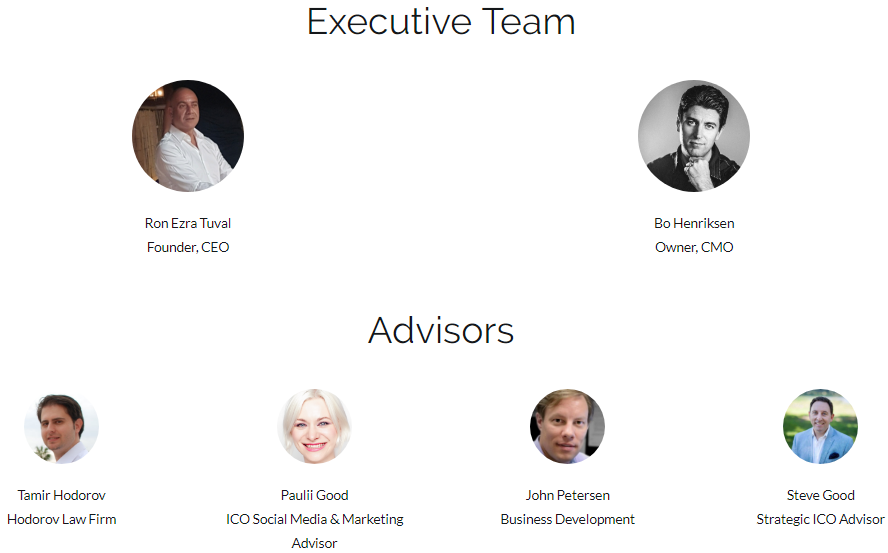

L-Pesa was established with the vision to enhance individuals' lives through effective access to credit and related money related administrations. Ron Ezra Tuval, the author of L-Pesa, has spent the majority of his vocation working in creating nations and perceived about 10 years back that the best method to enhance individuals' lives is through access to credit and related money related administrations. Since establishing L-Pesa, Ron has been uniquely centered around accomplishing this vision. It's tied in with improving the world a place for everybody. L-Pesa began offering microfinance benefits in Tanzania in 2016 and has developed its administration offering and geographic impression at an expanding pace in quest for this vision.

Elective Credit Data

Only 10 years back, there was almost no information accessible on a large portion of the general population on the planet. This has changed with the coming of online networking and related patterns. New devices have been created to settle on this information valuable for basic leadership in credit endorsing. L-Pesa has built up a one of a kind, restrictive credit scoring model in light of client conduct joined with conventional and elective credit information. L-Pesa contenders have built up their own restrictive models. Experience throughout the following decade will prompt amended accepted procedures, which will in the long run move toward becoming industry models.

L-Pesa has assembled an exclusive credit endorsing framework which is one of the keys to its prosperity. Purchaser acknowledge detailing as it is accessible in Western Europe and North America does not exist in Africa, India, or other creating areas. Various models have been attempted throughout the years, some with more accomplishment than others. L-Pesa's model is situated to some degree on a put stock in step: clients begin with little credits (commonly $1.00) and are permitted bigger advances after the littler advances have been effectively reimbursed on plan. Effective reimbursement adds to a FICO assessment. The financial assessment is additionally affected by different variables, for example, culmination of character check. Moreover, L-Pesa depends on other specialist co-ops to screen clients; in its present markets, L-Pesa clients are required to have set up accounts with portable cash specialist co-ops, for example, M-Pesa preceding setting up a L-Pesa account.

About L-pesa

L-Pesa Microfinance is a fintech startup poised to take advantage of the fast-growing need for financial services in the developing world. The company has validated its operating model over the past 18 months and has built sophisticated technology, automating most of the operation. Its primary barrier to growth at this point is its ability to fund user acquisition and loans.

The loss ratio on loans runs below 10% while return on loans is

approximately 25%.

The idea for L-Pesa was incubated for a decade, and the business was launched at the time four important market forces converged to allow scaling:

- Big Data, Artificial Intelligence & Blockchain

- Alternative Credit Data

- Mobile Technology

- Biometric Identity

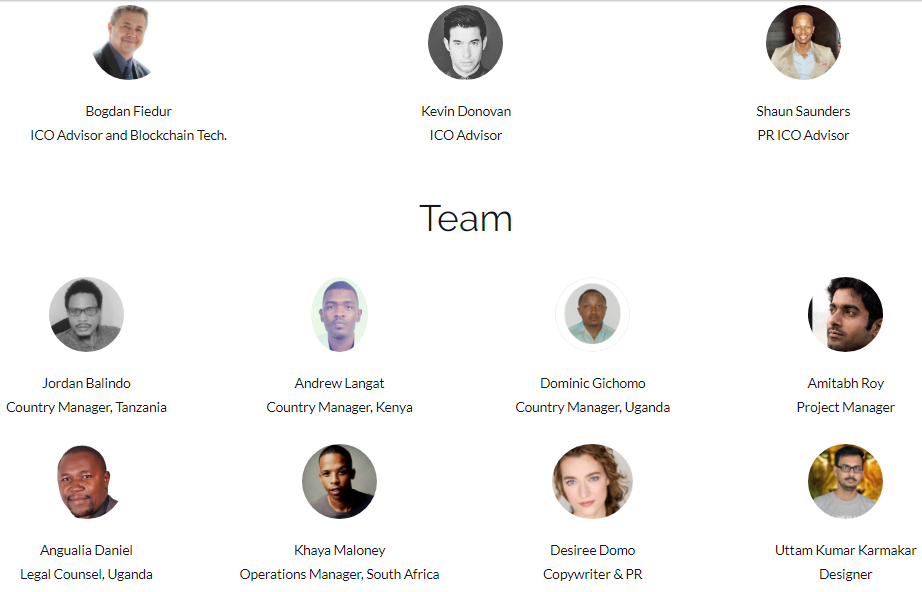

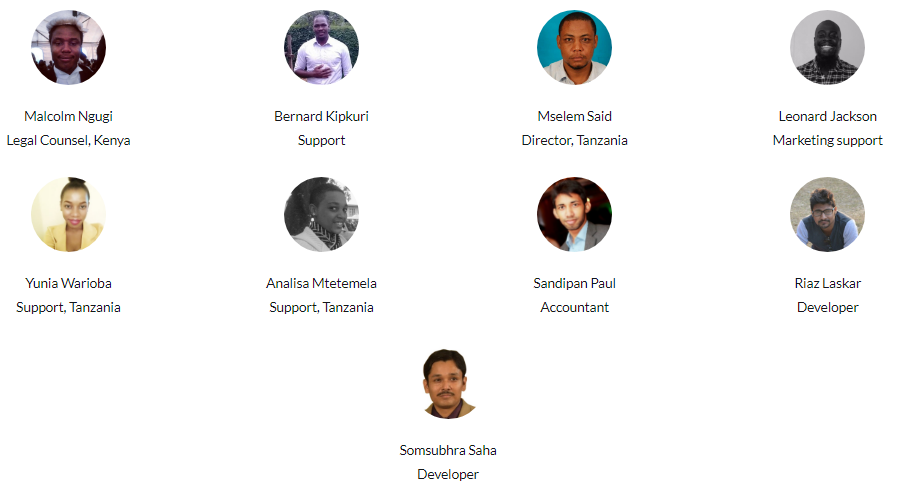

Ron Ezra Tuval, the founder and managing director of L-Pesa, has extensive experience in the developing world, primarily related to technologies-related agriculture and tourism projects. Ron first came across microfinance in South East Asia and spent a decade incubating the idea of L-Pesa while waiting for the required technology to mature. Ron has built a strong and diverse team for L-Pesa with in-country managers operating in Tanzania, Kenya, and Uganda, and a development team in India. There is also a back office team in Tanzania, Kenya, and Uganda handling background checks, credit approvals and customer service. The technology, marketing, and accounting teams operate on a virtual model and consist of experienced staff based in Europe, USA, and India.

L-Pesa has a strong focus on automation. 95% of the user acquisition and loan underwriting process is automated and therefore extremely scalable. The company has spent two years developing its customer-facing and back office systems using a team of seven software developers. The user 832754982.1 4

experience is based on mobile and web interfaces, and marketing is primarily handled via social media and SMS-based marketing.

L-Pesa’s technology stack is built on top of Amazon Web Services, an extremely scalable on-demand cloud computing platform which has been or is used by major brands such as Netflix, Airbnb, Pinterest, and Spotify.

L-Pesa has integrated a number of third party applications to perform tasks such as SMS messaging, user verification, and marketing. Funds transfers are handled via integrations with mobile money service providers such as M-Pesa, Tigo Pesa, and MTN.

L-Pesa has issued over 35,000 loans since going live in March 2016. Over 160,000 users have registered based on social marketing campaigns run on a minimal budget. The marketing strategy has been refined over the past 18 months, and L-Pesa is now prepared to launch marketing campaigns via SMS and social media with a conservatively projected customer acquisition cost of

$1.00.

The founder of L-Pesa, has invested approximately $500,000 to date. The business was launched in Tanzania in 2016 and in Kenya in August 2017.

Soft launches are underway in Uganda and India. The company’s technology is stable, scalable, proven, and will support the company’s growth plans. At this point, L-Pesa has hit a growth barrier—there is not enough capital available to lend to everyone interested, and the potential for user acquisition is almost unlimited, but requires capital for marketing expenses and support staff. The company is now raising funds to take advantage of its

leading position, strong platform, and nearly unlimited opportunity to extend financial options to a large portion of the earth’s population.

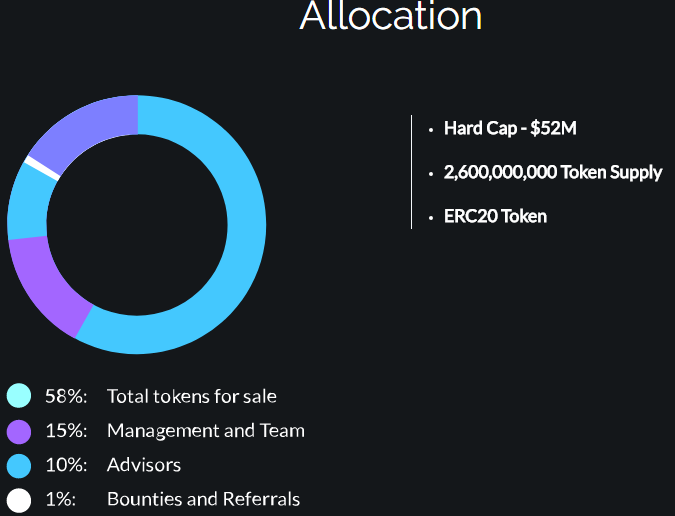

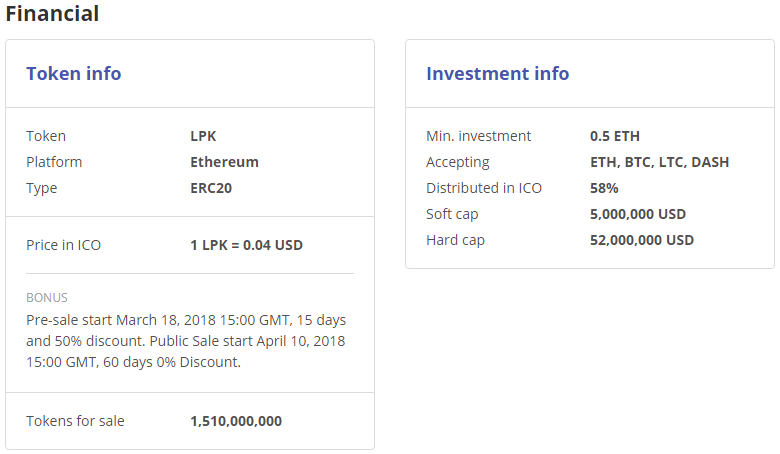

- Token LPK

- Price 1 LPK = 0.04 USD

- Bonus Available

- Bounty Available

- Platform Ethereum

- Accepting ETH, BTC, LTC, DASH

- Minimum investment 0.5 ETH

- Soft cap 5,000,000 USD

- Hard cap 52,000,000 USD

- Country Gibraltar

- Whitelist/KYC KYC & Whitelist

- Restricted areas China, South Korea, New Zealand

January 2014

- L-pesa Microfinance was launched in January 2014. The idea was finally was finally put into practice.

- Tanzania operation launched, registered as L-pesa Microfinance.

- Kenya operation launched in August 2017.

- The company operates as "L-pesa Loans and credit limited.

- Uganda operation launched in February 2018.

- The company operates as "L-pesa Microfinance Ltd.

- Indie operation expected to launch June 2018.

- The company operates as "L-pesa Microfinance".

Website : https://kriptonofafrica.com

Whitepaper: https://kriptonofafrica.com/static/pdfs/L-Pesa%20ICO%20white%20paper%202018.pdf

Facebook: https://web.facebook.com/lpesaico

Telegram: https://t.me/LpesaICO

Twitter : https://twitter.com/lpesaico

https://bitcointalk.org/index.php?action=profile;u=1344739

Комментарии

Отправить комментарий